Categories:

A number of years ago I was a guest speaker at a banking conference, talking about social media. Before I could even begin the presentation, I was asked a question. Why, the attendees wanted to know, would a bank need to worry about social media?

“I know it’s a trend,” one of the attendees stated, “but it’s not like we sell clothes, or gourmet donuts, or home décor. What would we even post?”

Of course, this was a number of years ago, and social media was not what it is today. We also weren’t in the middle of a global pandemic, and customers were free to walk into a bank whenever they wanted and talk to a banker face to face. Times have certainly changed.

But even then, I gave the same answer that I give to banks today – because banking is personal.

This is true regardless of whether you’re a small credit union or a national bank – but it’s especially true for community banks, where the biggest selling point is connection and customization.

Many banks think that they are in the business of selling mortgages, or business loans. But the truth is that they’re selling much more than notarized paper – they’re selling dreams. They’re selling opportunities. They’re selling fresh starts.

In order to succeed with younger generations, banks need to look at their products in the way that consumers do. A mortgage is not just a loan to a Millennial – it’s their first home, their independence, and some serious responsibility. A business loan isn’t just a way to get started – it’s a stamp of approval on an idea and a vote of confidence that it can be done. Perhaps a loan is someone’s college education, ability to adopt a child, or the start of a non-profit that will someday change the world. All of these ventures are deeply personal, not simply transactional.

When consumers choose their bank, they’re looking for more than money or convenience or deposit slips – they’re looking for a partner that believes in them and genuinely cares about their hopes, dreams, and goals for the future.

This is why so much of banking has historically been conducted in person. Relationships were with bankers – not banks. But today’s younger generations operate differently. They still want the personal connection – but they don’t want to have visit a bank (or pick up a phone) to do it. Enter: social media.

It’s the place where people come together and share their hopes, their triumphs, and their exciting news. It’s a place designed for connection and interaction. This makes it an ideal platform for banks to connect with their audience and show them that they care – not just about selling mortgages, but about building community. It’s a place to build trust and form connections – all without picking up a phone, or walking into a branch. Facebook and Instagram are like the match.com of Millennials and community banks.

Still not sure what to post on social? Here are three great examples of community banks using social media to build deeper connections with their target audience.

1. Norway Savings Bank – Live Your Life in Color

Norway Savings built their reputation on colorful banking solutions, treating customers like individuals, and fostering a fun office culture that celebrates out of the box thinking. Their goal for social media was to build on that success and bring younger customers into the bank.

It wasn’t much of a surprise, in our research, to learn that young people (err, most people) do not think about their banks every day. Our creative strategy was a nod to the idea that maybe, just maybe, it’s not the bank’s financial solutions that are so colorful and important. But rather, it is the colorful ambition of their customers that matters most.

So Norway focused their social media not on themselves – but on the incredible, colorful things their customers were doing. From traveling the world to starting businesses to bringing their dreams of homeownership to life, Norway’s social media pages feature the stories of clients that have worked with Norway to bring even more color and vibrance to their communities.

In addition to their client features, Norway Savings Bank also used their social platforms to highlight their own most colorful asset – their employees. The What a Banker Looks Like campaign highlighted the fun and colorful lives of the many different bankers that work at Norway Savings. The campaign did an excellent job of connecting with the target audience and making banking (and bankers!) feel more approachable to Millennials.

2. First National Bank – Dream First

First National Bank’s Dream First campaign (which was designed for both broadcast television and social media) was created to encourage people to dream big, see the glass half-full, and go for it in life. It’s a statement of belief in the community and in one another. The campaign launched with a 60-second anthem, shot by local filmmakers across Maine, and has been supported by additional videos featuring specific aspirations such as homeownership and entrepreneurship, as well as social media posts featuring local people and businesses whose dreams are supported by First National Bank.

The Dream First campaign provides the bank with ample content for social media, and also establishes them as a voice and advocate for the community they serve. It’s also a great way for the bank to engage in conversations with the community about their collective vision for the future.

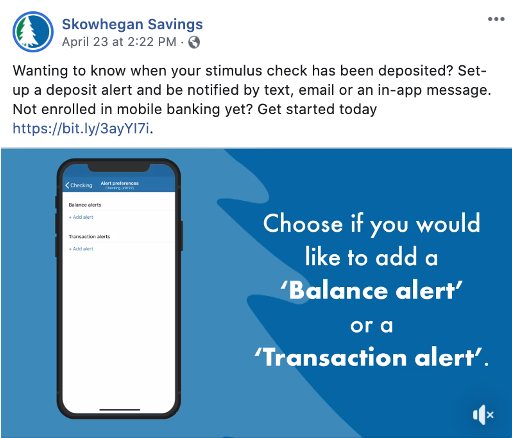

3. Skowhegan Savings Bank

When the pandemic hit, Skowhegan Savings Bank knew that their role in the community would become more important than ever. They immediately began to leverage their social media presence as an educational tool to help both individual and business customers understand the various financial tools that were being made available to them and how to access them.

Using social media as an educational platform is a great to way to get the attention of potential customers on social media and highlight all the ways a local bank can help. Especially now that customers can’t simply walk into a branch for assistance, social media has become an increasingly important customer service touchpoint for both existing and potential new banking clients.

The Takeaway

In order to connect with your customers, you need to get personal with them. Your bank or credit union is in the business of making dreams and opportunities happen, and social media is a critical channel for conveying and connecting with your audience on those aspirations.

About Ethos

Ethos is a multiplatform branding agency that develops and executes integrated marketing campaigns across multiple channels for companies inside and outside of Maine.

At Ethos, we believe that the most effective way to set a company’s marketing course is by finding its core truth – its ethos. We know that once we discover and communicate that core truth, we can truly make a difference for each client’s unique marketing and business objectives.

With Ethos, you get more than a marketing agency. You get a long-term partner whose goals are your goals.

Learn more about the Ethos approach and the work we’ve done for our clients. Want to have a conversation about your brand’s core truth? Contact us!